Driving Progress, Improving Performance

In 2021, we committed to achieving net zero GHG emissions (Scope 1 and Scope 2) by 2035 to make meaningful change in support of global climate goals.

Our Pathway to a Net Zero Future

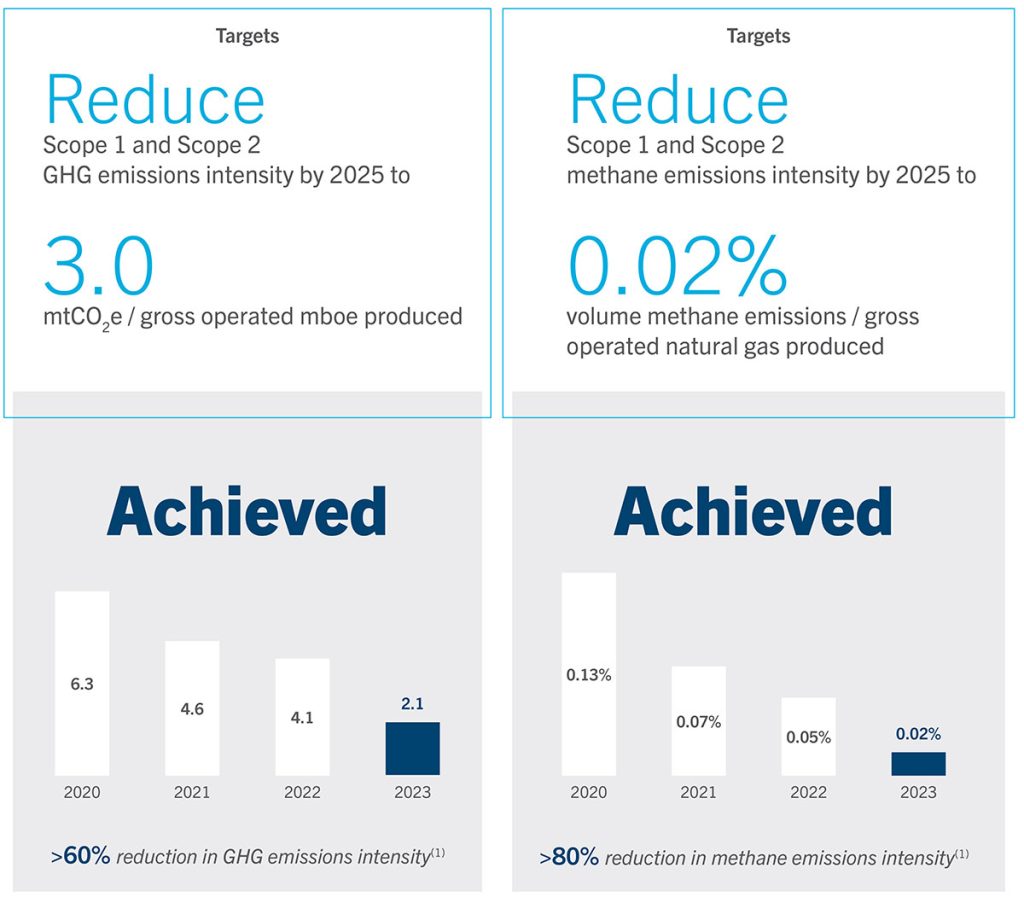

0.02%

(volume methane emissions / volume gross operated gas produced)

Reduce Scope 1 & 2 methane intensity by 2025

3.0

(mt CO2e / gross operated mboe produced)

Reduce Scope 1 & 2 GHG intensity by 2025

Net Zero

(enterprise-wide)

Scope 1 & 2 GHG emissions by 2035

Measured Progress Against Our Emissions Reduction Targets

Due to our A&D activity, we have retired one of our previously announced interim goals to best reflect our 2023 operations. In 2021, we pledged to eliminate routine flaring by 2025 with emphasis on our Eagle Ford assets. These assets were divested in three transactions, all completed in 2023. In our Haynesville and Marcellus assets, we don’t engage in routine flaring.

Continuing Our Pathway to Net Zero

Through capital allocation and a layered toolkit of technologies and best management practices, we will continue our measured progress in reducing emissions in support of our GHG emissions reduction goals.

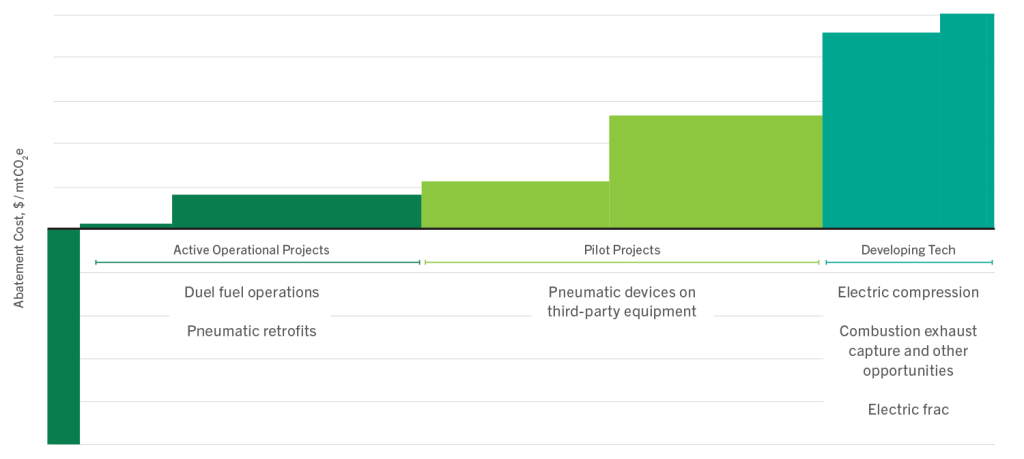

Our emissions-reduction approach is holistic, recognizing the opportunities for improvement across our operations and operational lifecycle. This approach starts by evaluating abatement projects according to the cost-benefit analysis they offer.

Our marginal abatement cost curve (MACC) is a useful tool for strategic planning to achieve our interim targets. Projects are high graded based on life cycle cost ability to scale, incremental value generated and volume of emissions abated. The MACC shown below is illustrative.

To date, Chesapeake has invested more than $30 million on emissions monitoring and reduction initiatives. Most of this investment was dedicated to retrofitting more than 19,000 pneumatic devices, offering significant emissions reductions. Chesapeake is actively engaged in the evaluation of and investment in emerging technology as we continue to chart our path to net zero.

MACC: Evaluating Emissions Abatement Opportunities

The above are examples of reduction opportunities and not exhaustive of all that Chesapeake is evaluating.

Identifying and Implementing Emissions Reduction Opportunities Across the Organization

| Strategies | Implementation |

|---|---|

| Advanced Emissions Assessment Better understand our emissions profile and adopt consistent industry methodology |

|

| Operations Excellence Utilize technology, best practices and energy efficient operations to reduce emissions |

|

| Credibility and Transparency Independent verification of processes with transparent disclosure of measurable progress |

|

| Innovation Adopt technology and engage in partnerships and investments to support a lower carbon future |

|

Exploring Emerging Technologies, Partnering for Progress

We recognize that supporting these programs requires significant research and development capital, which involves a certain degree of risk. We’re committed to spending capital to deliver improved performance in this area, and we’re also exploring pooling resources with other companies for more efficient technology analysis and development. Part of our partnership strategy is centered on looking beyond Chesapeake’s core upstream business and exploring opportunities with our midstream and downstream providers and the end users of our fuel.

Additionally, we’re exploring opportunities to engage partners outside the traditional oil and natural gas value chain, including agricultural solutions for carbon renewal or sequestration. Our analyses focus on the effectiveness of each prospective technology from a technical, operational and economic standpoint.